BE PREPARED TO PAY INCREASED PENALTIES FOR ERISA VIOLATIONS

Up-to-Date Guidance on the Latest Legal Developments in Employee Benefits and Executive Compensation

By Daniel N. Janich on July 28, 2016

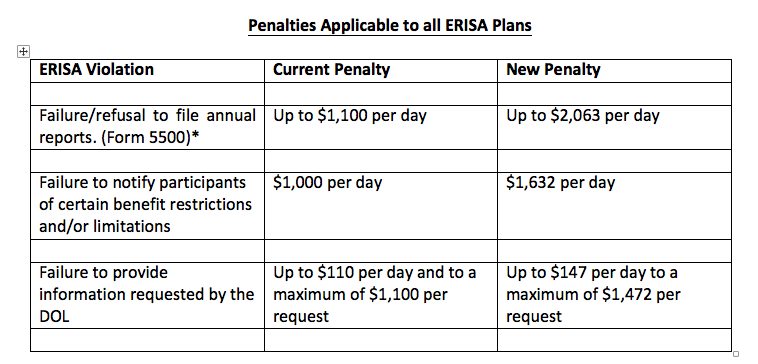

On June 30 of this year the Department of Labor (“DOL”) issued an interim final rule increasing civil monetary penalties imposed on employers for violations of the Employee Retirement Income Security Act. (ERISA). The upwardly adjusted penalties, which will affect both pensions and welfare plans, are based on the Federal Civil Monetary Penalties Inflation Adjustment Improvements Act of 2015. After this initial increase, and beginning in 2017, the DOL will adjust the civil penalties for inflation by January 15 of each year. The DOL will issue final regulations before the end of this year.

The increased penalties will be assessed starting on August 1, 2016 for violations that took place after November 2, 2015. Notably, although some increases may appear minimal, the aggregate amount could be quite significant to the extent that the penalties are assessed per employee and/or per day for the period of the violation. A select number of these penalty increases are described below:

Recommended Course of Action

This increase, which for some violations is rather significant, should prompt employers to immediately review the operation of their ERISA covered plans to ascertain whether they are in compliance with ERISA’s requirements. Under the newly adopted increasing penalties regimen as described above, an employer now has even more reason to monitor its plan administration and procedures proactively to avoid ERISA violations.

This blog entry is intended for information and planning purposes only. It is not intended and should not be treated as a substitute for legal advice that must take into account specific facts and circumstances of clients.